1. Context of the Insurance Sector in the AML/CFT/CFP System

1.1 Applicable Regulatory Framework

The Dominican insurance sector is subject to an AML/CFT/CFP prevention regime that includes:

| Regulation | Scope |

|---|---|

| Law 155-17 | General legal framework for prevention |

| Decree 408-17 | Application regulation |

| Insurance Superintendency AML/CFT Regulation | Sector-specific regulation |

| UAF 2026 Due Diligence Guide | Unified technical guidance |

1.2 Particularity of the Insurance Sector

The 2026 Guide and Decree 408-17 establish a fundamental particularity for the insurance sector:

"In the case of insurance, due diligence applies only to life insurance and to insurance that includes any investment component."

— Art. 15 of Decree 408-17, reiterated in the 2026 Guide

However, the 2026 Guide introduces an important note:

"Without prejudice to the provisions of the Application Regulation of Law No. 155-17, it is the responsibility of obligated subjects to maintain adequate controls to evaluate and manage the level of risk exposure of each product or service offered. In this sense, the application of due diligence measures is fundamental and recommended to ensure the quality of the information that supports the evaluation of inherent risks, particularly regarding the client factor, even when the product is not categorized as high risk due to its financial nature."

1.3 Obligated Subjects in the Sector

According to the 2026 Guide, the Insurance Superintendency supervises:

- Any person authorized to operate in the Insurance Sector

This includes:

- Insurance companies

- Reinsurance companies

- Insurance brokers

- Insurance agents

- Other authorized intermediaries

2. Analysis of the 2026 Guide Impact

2.1 General Implications for the Sector

2.1.1 Expansion of the Risk-Based Approach

Key change: The 2026 Guide suggests that, although mandatory DD is limited to life and investment insurance, it is recommended to apply proportionate controls to all products according to their risk exposure.

Practical implication:

- Insurers must evaluate whether other products (high-value property insurance, corporate liability insurance, etc.) warrant some level of due diligence

- This is especially relevant for high-value single premium policies or early surrenders

2.1.2 Cross-Institutional Responsibility

The 2026 Guide emphasizes that:

"This duty does not fall solely on the Compliance Officer, but constitutes a cross-institutional responsibility, involving all areas, functions, and organizational levels."

For insurers this means:

- Underwriting personnel must be trained in identifying red flags

- Claims areas must know DD criteria

- Commercial and customer service teams are the first line of defense

2.2 Application of the Nine Guiding Principles

| Principle | Application in Insurance |

|---|---|

| Risk-Based Approach | Evaluate each product according to its exposure; life insurance with savings component requires more scrutiny |

| Proportionality | Low-value policies may require simplified DD; high-value investment policies require enhanced DD |

| Reasonableness | Do not require excessive documentation for low-value term life insurance |

| Sufficiency and Verifiability | Adequately document information about the insured and beneficiaries |

| Continuous Update | Review beneficiary information periodically, especially in life insurance |

| Documentation and Traceability | Maintain complete files of the insured/beneficiary |

| Institutional Coherence | Train underwriters, agents, and claims areas |

| Technical Independence | Acceptance decisions should not yield to commercial pressures |

| Confidentiality | Protect personal information of insureds |

2.3 DD Methodology Applied to Insurance

Phase 1: Identification

In life/investment insurance:

- Complete data of the policyholder

- Data of the insured (if different)

- Identification of all beneficiaries (critical)

- Information about source of funds for premiums

- Purpose of the insurance

Phase 2: Measurement

Specific risk factors:

- Premium amount (single or periodic)

- Relationship between premium and declared economic capacity

- Designation of beneficiaries (unrelated third parties = greater scrutiny)

- Jurisdiction of beneficiary residence

- History of beneficiary changes

Phase 3: Control

Measures according to risk level:

- Automatic acceptance limits

- Escalation to Compliance for complex cases

- Additional verifications for elevated premiums

- Restrictions on premium payment methods

Phase 4: Monitoring

Events requiring review:

- Change of beneficiaries

- Early surrender (especially if partial and frequent)

- Policy loan requests

- Claims with previously unknown beneficiaries

2.4 Beneficial Owner in Insurance

The 2026 Guide establishes that the BO includes:

"Designated beneficiaries in insurance or financial instruments"

Implications for the sector:

- Mandatory identification of beneficiaries:

- Full name

- Identity document

- Relationship with the insured

- Address and contact information

- Risk-based verification:

- Beneficiaries unrelated to the insured = greater scrutiny

- Multiple beneficiaries with equal shares without clear justification

- Beneficiaries in high-risk jurisdictions

- Update:

- Review beneficiaries at each renewal (periodic insurance)

- Verify beneficiaries at the time of claim

2.5 Source of Funds in Insurance Premiums

The distinction the 2026 Guide makes between source of funds and source of wealth is especially relevant for insurance:

| Scenario | Verification Level |

|---|---|

| Periodic premium consistent with declared income | Standard |

| Significant single premium amount | Source of funds verification |

| PEP acquiring life insurance with investment | Verification of source of funds AND wealth |

| Early surrender with payment to third party | Enhanced scrutiny |

2.6 Politically Exposed Persons (PEPs)

Specific treatment for insurance:

- Detection:

- Verify PEP status of policyholder/insured

- Verify PEP status of beneficiaries (new emphasis in 2026 Guide)

- Consider family members and close associates

- Enhanced measures:

- Senior Management approval

- Verification of source of funds for premiums

- Intensified relationship monitoring

- Exhaustive documentation

- Anti-de-risking policy:

The 2026 Guide warns against automatically rejecting PEPs. Insurers must:

- Apply objective criteria

- Document risk analysis

- Implement reasonable mitigants

- Only reject when risk is unacceptable

2.7 Ongoing Due Diligence in Insurance

Sector particularity:

Life and investment insurance are long-term business relationships, which implies:

| Activity | Suggested Frequency |

|---|---|

| Update of insured data | Annual or at renewal |

| Review of beneficiaries | At each change and at least annually |

| Premium consistency verification | Continuous |

| Analysis of surrenders/loans | Per event |

| Complete file review (high risk) | Annual |

Trigger events for additional DD:

- Significant increase in premium amount

- Change of beneficiaries to unrelated persons

- Early surrender request within a short period

- Premium payment by third parties

- Address change to high-risk jurisdiction

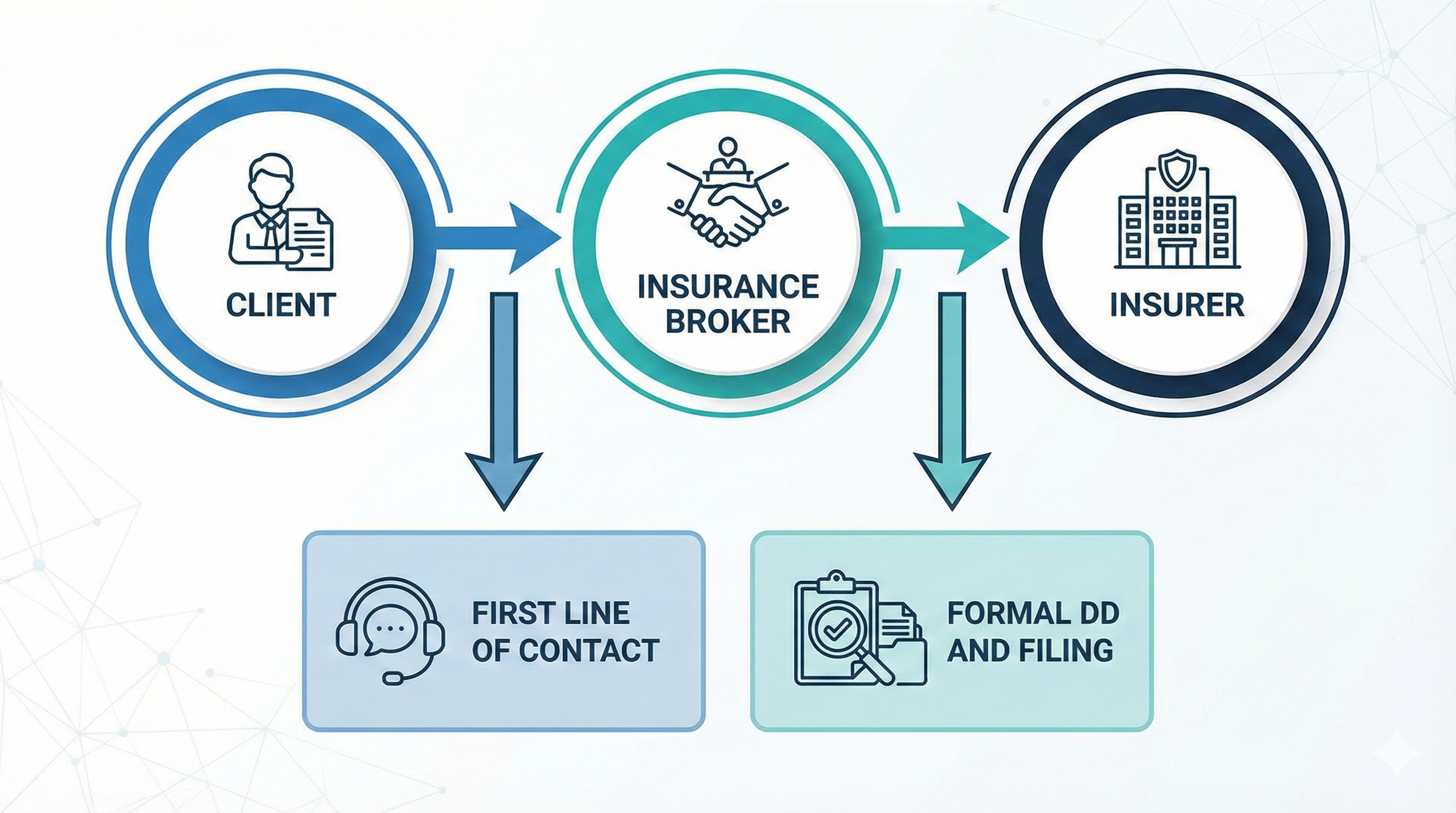

3. Special Analysis: Insurance Brokers

Nature of the Broker Relationship

Insurance brokers act as intermediaries between the client and the insurer. This poses specific challenges:

3.2 Broker Obligations According to the 2026 Guide

3.2.1 As an Independent Obligated Subject

The insurance broker is an obligated subject in its own right, not merely a channel for the insurer. They must:

- Implement their own Compliance Program:

- DD policies and procedures

- Designated Compliance Officer

- Staff training

- Reporting system

- Apply DD to their clients:

- Even if the insurer conducts its own DD

- Especially for life and investment products

- Proportional to their risk level and operational capacity

- Report suspicious operations:

- Directly to the UAF when red flags are identified

- Regardless of whether the insurer accepts or rejects the policy

3.2.2 Specific Red Flags for Brokers

In insurance placement:

- Client who insists on a life policy with high investment component without apparent need

- Client who shows no interest in coverage, only in surrender value

- Premiums significantly higher than apparent economic capacity

- Request for premium payment by unrelated third parties

- Multiple applications for different people with same address/contact

- Frequent beneficiary changes in existing policies

In post-sale service:

- Early surrender requests shortly after issuance

- Recurring inquiries about surrender procedure

- Policy loan requests for unclear purposes

- Reluctance to provide information for updates

3.2.3 Documentation the Broker Must Maintain

According to the 2026 Guide requirements (10-year retention):

| Document | Purpose |

|---|---|

| Know Your Customer form | Identification |

| Copy of identity documents | Verification |

| Information about insurance purpose | Understanding the relationship |

| Premium vs. economic profile coherence analysis | Risk assessment |

| Communications with the client | Traceability |

| Red flag register and analysis | Compliance evidence |

| Report to insurer on findings | Coordination |

3.3 Broker-Insurer Relationship in DD

3.3.1 Complementary Responsibilities

| Aspect | Broker | Insurer |

|---|---|---|

| Initial identification | Yes | - |

| Formal identity verification | May delegate | Yes |

| AML/CFT risk assessment | Yes | Yes |

| Acceptance decision | Recommends | Yes |

| Formal file archive | Copy | Original |

| Ongoing monitoring | Operational (client contact) | Formal |

| Report to UAF | Yes (independent) | Yes |

3.3.2 Non-Delegation of Responsibility

Critical point from the 2026 Guide: Due diligence cannot be fully delegated. The broker cannot assume the insurer will do all the work, nor vice versa.

Article 35 of Law 155-17, cited in the 2026 Guide, establishes that:

"Due diligence does not end with final clients... proportionate measures of knowledge and risk assessment must be applied to critical suppliers, intermediaries, correspondents, and commercial alliances."

This means insurers must:

- Apply DD to their brokers as related third parties

- Verify that brokers have compliance programs

- Establish red flag communication protocols

3.4 DD Model for Insurance Brokers

3.4.1 Simplified DD (Low Risk Products)

Applies when:

- Low-value term life insurance

- Periodic premium consistent with evident economic profile

- Beneficiaries are direct family members

Actions:

- Collect minimum information from the KYC form

- Basic identity verification

- Document insurance purpose

- File copy of documents

3.4.2 Standard DD (Medium Risk)

Applies when:

- Life insurance with savings/investment component

- Moderate premium amounts

- Identified and related beneficiaries

Actions:

- Complete Know Your Customer form

- Identity verification

- Information about economic activity and source of funds

- Premium vs. capacity coherence analysis

- Sanctions list screening

- Complete documentation

3.4.3 Enhanced DD (High Risk)

Applies when:

- PEP or family member/associate of PEP

- High premium amounts or significant single premium

- Unrelated beneficiaries or beneficiaries in high-risk jurisdictions

- Complex structures (trusts as beneficiaries)

- Applications that do not match economic profile

Actions:

- All of the above, plus:

- Enhanced verification of source of funds

- Source of wealth analysis if warranted

- Additional supporting documentation

- Escalation to Senior Management for approval

- Notification to insurer about risk level

- Intensified monitoring

3.5 Relevant Practical Cases for Brokers

Case 1: PEP Client Seeks Life Insurance with Investment

Scenario: A high-level government official requests universal life insurance with a single premium of DOP 5,000,000.

Broker actions:

- Identify PEP status

- Apply enhanced DD

- Request source of funds documentation

- Verify consistency with asset declaration (if publicly available)

- Document complete analysis

- Notify insurer of PEP status before formal quotation

- Obtain Senior Management approval from both parties

- If accepted, establish enhanced monitoring

Case 2: Frequent Beneficiary Changes

Scenario: A client with a life and investment policy has changed beneficiaries three times in the last year, each time to different people with no evident family relationship.

Broker actions:

- Document the observed pattern

- Request explanation from the client about the changes

- Verify identity and relationship of new beneficiaries

- Evaluate whether changes are consistent with the original insurance purpose

- Consider if this constitutes a red flag

- If concern persists, escalate to Compliance

- Communicate to the insurer

Case 3: Early Surrender Request

Scenario: A client requests total surrender of their life investment policy just 18 months after purchase, with significant loss.

Broker actions:

- Document the request and stated reasons

- Evaluate coherence of the explanation

- Verify if there are changes in client circumstances

- Confirm that payment will go to the policyholder

- If payment to a third party is requested, enhanced scrutiny

- Communicate to insurer for processing

- Document analysis in file

4. Insurance Sector-Specific Red Flags

4.1 At Contracting

| Red Flag | Level |

|---|---|

| Premium disproportionate to declared income | High |

| Insistence on paying high-amount premium in cash | High |

| Premium payment by unrelated third party | High |

| Multiple life policies with different insurers | Medium-High |

| Beneficiaries in high-risk jurisdictions | High |

| Beneficiaries that are opaque legal entities | High |

| Client shows no interest in coverage, only in surrender | High |

| Request for policy with very high single premium | Medium |

| Reluctance to provide source of funds information | High |

| Unjustified urgency to complete the contracting | Medium |

4.2 During Policy Term

| Red Flag | Level |

|---|---|

| Frequent beneficiary changes | Medium-High |

| Policy loan requests for unclear purposes | Medium |

| Early surrender with significant loss | High |

| Request for surrender payment to third party | High |

| Fractioning of surrenders in amounts just below thresholds | High |

| Sudden premium increase without justification | Medium |

| Policy assignment to unrelated third party | High |

| Reluctance to update contact information | Medium |

4.3 At Claims

| Red Flag | Level |

|---|---|

| Previously unknown beneficiary | High |

| Claim very close to contracting date | Medium-High |

| Inconsistencies in claim documentation | High |

| Pressure for quick payment without normal process | Medium |

| Beneficiary reluctant to fully identify themselves | High |

5. Implementation Recommendations

5.1 For Insurers

- Update the Compliance Manual incorporating:

- Guiding principles of the 2026 Guide

- Four-phase DD methodology

- Differentiated criteria by product type

- Specific treatment of beneficiaries as BOs

- Train personnel from:

- Underwriting

- Customer service

- Claims

- Commercial

- Establish protocols with brokers:

- DD requirements they must meet

- Information they must collect

- Alert communication procedure

- DD on brokers themselves as intermediaries

- Implement technological controls:

- Identity validation

- List screening

- Alerts for unusual patterns

- Review PEP policy:

- Avoid automatic de-risking

- Document acceptance criteria

- Establish enhanced monitoring

5.2 For Insurance Brokers

- Formalize Compliance Program (if not in place):

- Written policies and procedures

- Designation of compliance responsible

- Staff training

- Implement DD process:

- Know Your Customer form

- Verification procedure

- Escalation criteria

- Document filing

- Establish alert system:

- Insurance-specific red flag list

- Analysis procedure

- Documentation format

- Communication channel with insurers

- Maintain independence:

- Direct report to UAF when appropriate

- Do not rely exclusively on insurer's DD

- Document everything:

- Analyses performed

- Decisions made

- Communications with clients and insurers

- Retain for 10 years

6. Conclusions

The UAF 2026 Due Diligence Guide has significant implications for the Dominican insurance sector:

For Insurers:

- Although mandatory DD remains limited to life and investment insurance, it is recommended to evaluate proportionate controls for other high-value products

- Treatment of beneficiaries as "beneficial owners" requires greater diligence in their identification and verification

- The anti-de-risking policy for PEPs requires a more nuanced approach

- Responsibility is institutional and cross-cutting, not only the Compliance area's

For Insurance Brokers:

- They are independent obligated subjects with their own responsibilities

- They must implement compliance programs proportional to their operation

- They act as the first line of defense in identifying red flags

- They cannot fully delegate their responsibility to insurers

- They must maintain their own documentation and report directly to the UAF when appropriate

Effective implementation of these guidelines will strengthen the integrity of the insurance sector and its contribution to the national AML/CFT/CFP prevention system.